While it might seem a bit baffling at first, the use of the Reverse Charge VAT in construction is relatively easy to understand with the right advice.

The initial issue to clarify is, where you fit in the chain of payment. What you must do in regard to VAT and when this must be done, all depends upon this.

Are you a subcontractor or main contractor?

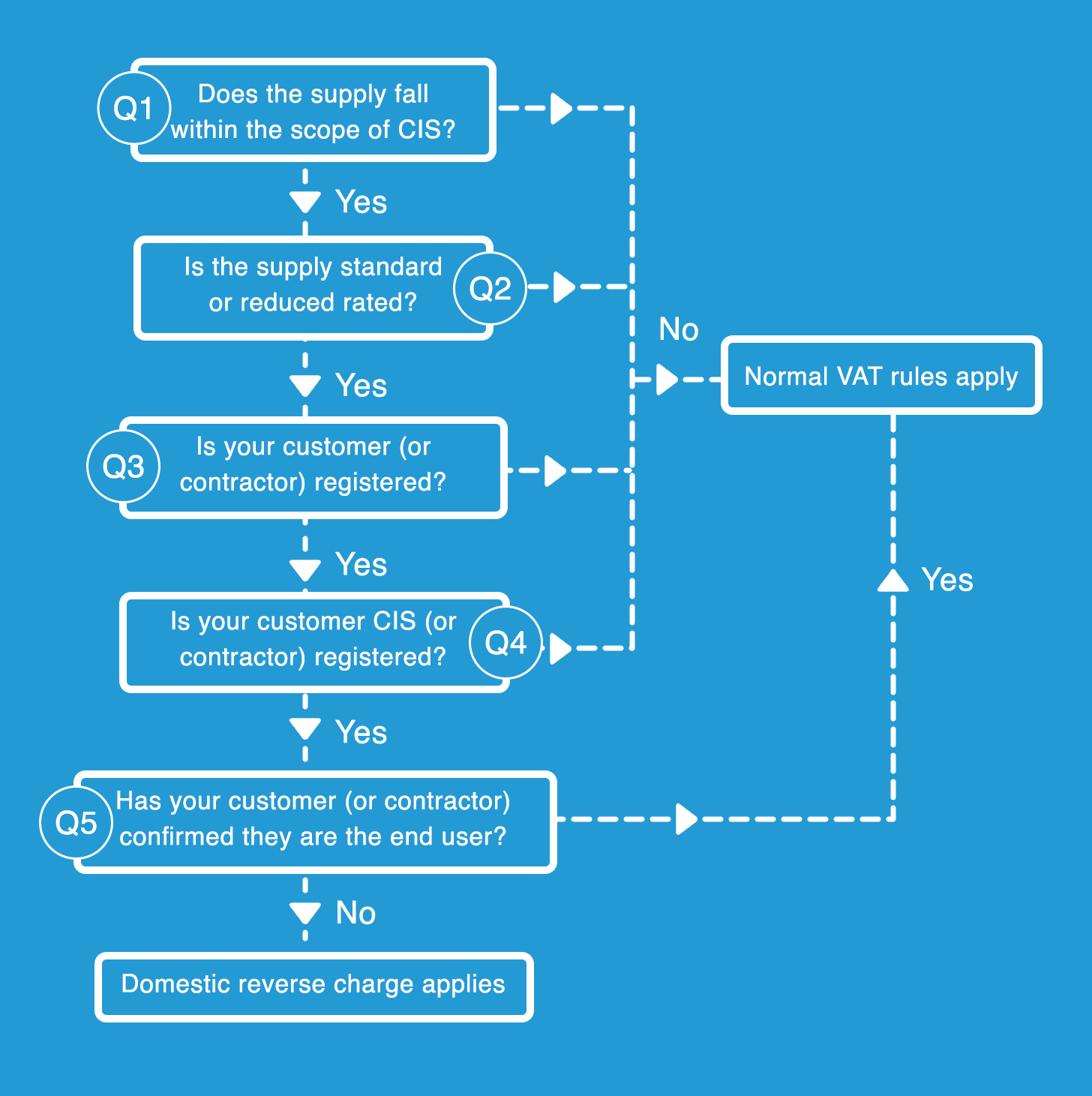

Once you are clear on this, the rest falls into place. You can use the following charts to assess this.

As explained in this chart, Subcontractor 1 is providing a construction service to Subcontractor 2, but not directly to the customer.

When preparing their invoice Subcontractor 1 does not include the VAT in their invoice. But must write within the invoice that the Main Contractor must deal with the VAT on their own return, by applying the Reverse Charge.

So instead of the Main Contractor paying the VAT to Subcontractor 1, who would then pay the VAT to HMRC, the VAT is carried forward to the Main Contractor who then pays it to HMRC.

The arrow shows how the Reverse Charge is applied as it goes through the chain. The VAT ends with the customer, also known as the End User, who commissioned the entire project.

How do the new rules affect me?

Subcontractor

If you are sending an invoice to another contractor or customer, you either must charge the normal amount of VAT or apply the reverse charge.

If this is the case you do not need to put the amount in the invoice, but you do need to make the contractor aware that you have applied the reverse charge and that they will need to pay it. You do not need to put this on your VAT return

Main Contractor

When receiving a reverse charge invoice from a subcontractor, it should be recorded as a normal expense invoice. Input VAT should be recorded on your normal VAT return.

What about if I am both?

It could be the case that you fall into both categories on different projects, so you need to be aware of this and manage your VAT accordingly.